Global supply chain problems look set to worsen as lockdowns caused by a new wave of COVID-19, the Russia-Ukraine conflict and other factors lead to longer delays at ports and further push up costs, according to a new report from Royal Bank of Canada released on Tuesday.

Container ships unload at the port of Long Beach, California

Research by analysts at Royal Bank of Canada (RBC) found that one-fifth of the world’s container fleet is currently congested at major ports. The total number of ships currently waiting for berths in East China is 344, an increase of 34% over the past month; coupled with the bottleneck of inland transportation in the United States, it is taking much longer than usual for goods to be shipped to US warehouses. Also in Europe, ships from Asia were delayed by an average of four days, causing some knock-on effects, including a shortage of empty containers carrying European-made goods to the U.S. east coast.

“Global port congestion is worsening and becoming more common,” Michael Tran, RBC’s head of digital intelligence strategy, and his colleague Jack Evans said in the report, acknowledging that it’s hard to say when the situation will improve. Ships and containers must be available at the correct time and place to prevent cancellations. Any mismatch will cause the vessel to operate at full capacity, thus requiring more vessels to carry the same amount of cargo. The RBC said the plethora of issues was having “a domino-like negative compounding effect across markets”.

★ Ship Delay ★

The Russian-Ukrainian conflict that erupted in late February, when several ships sank in the Black Sea, has prompted insurers to increase insurance premiums from 0.25% before the conflict to 1% to 5%. Meanwhile, bunker prices in Singapore, the world’s largest refuelling port, have risen 66% over the past year. “Many market participants mistakenly assumed that supply chain issues would be resolved so far, but this scenario has failed to materialize,” the report said. Congestion at ports around the world is worsening and becoming more common.

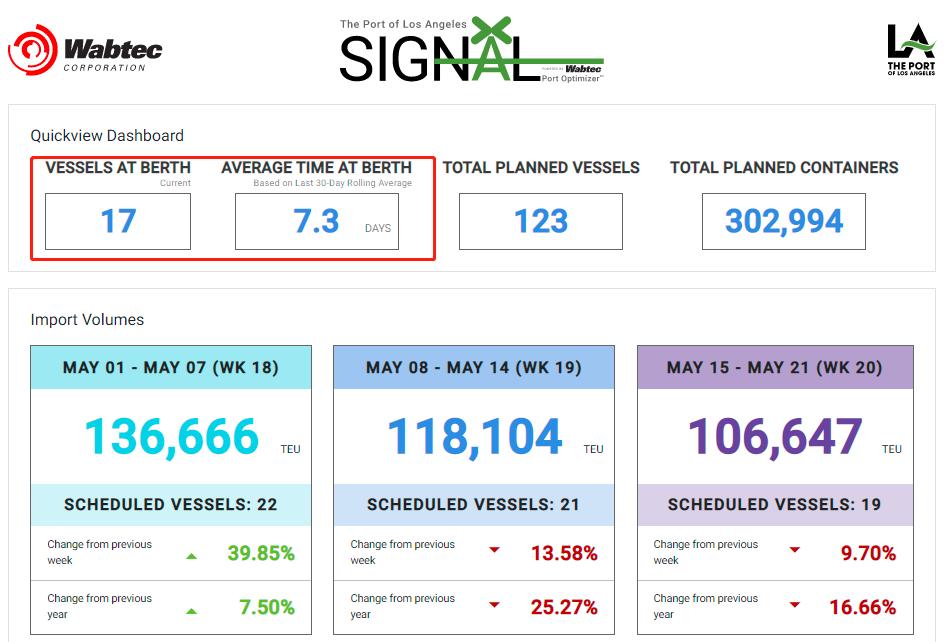

The Royal Bank of Canada (RBC) noted that while ship delays have improved slightly over the past few months, the average global ship delay in March remained at 7.26 days, rarely exceeding 4.5 days under normal circumstances. On the U.S. West Coast, the ports of Los Angeles and Long Beach struggled to catch up and still struggled to keep up. Currently, 17 ships are still waiting in line in Los Angeles, and port inefficiencies have caused the turnaround time (ToT) to jump to 7.3 days from 5 days a month ago, although it is still below the peak of 8.7 days in the pre-Christmas peak last year.

In Europe, Russia’s “special military operation”meant several major shipping lines suspended shipments into the Baltic and Black Seas. Several major European countries have also banned Russian-flagged ships from entering their ports. This has changed shipping routes and has driven increased activity by container ships into European ports. The three largest container ports in Europe, Rotterdam, Antwerp and Hamburg, are 8%, 30% and 21% above their five-year normal levels in total turnaround time (ToT). “The turnaround time (ToT) needs to be drastically reduced before we can confidently come up with a path to normalisation of transport costs,” said RBC analysts. “But the question? It’s getting worse now.”

★ U.S. manufacturers’ supply chain chaos intensifies ★

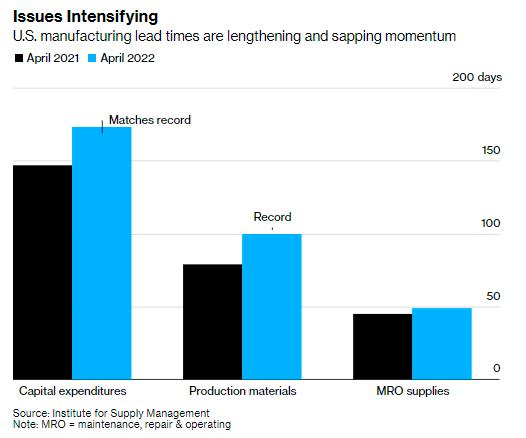

The storm of supply chain chaos for U.S. manufacturers intensified, with lead times for materials and equipment hitting their highest level in April. It takes an average of 100 days to receive production materials, the longest on record since 1987, figures from the Institute for Supply Management showed on Monday. For capital expenditures, the average commitment time rose to a staggering 173 days, matching the highest level on record.

In addition to shipping and shipping delays, the inability to hire also complicates the problem for producers. Some 34% of respondents to the ISM survey who were hiring said it was difficult to fill vacancies, up from 28% a month ago. The job market is severely tight. Growing capacity constraints in labor and logistics have led to slower growth in production and new orders, according to ISM.

“Demand remains strong, but factories simply can’t keep up as supply constraints prevent expansion of production,” Stephen Stanley, chief economist at Amherst Pierpont Securities, said in a note. The outbreak has led to negative impacts on the third quarter, said a purchasing manager at a manufacturing company. Initial supply concerns. In response, buyers said the company was extending customer lead times and ordering products to meet demand in the first quarter of next year.

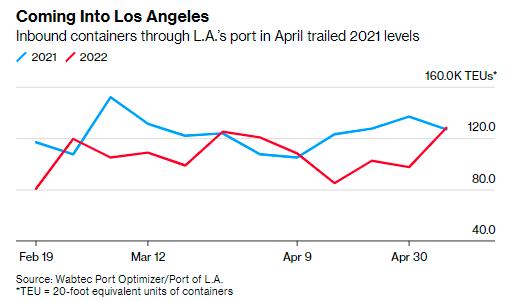

While the headline factory purchasing managers index unexpectedly fell last month to its lowest level since September 2020, Timothy Fiore, chairman of the ISM Manufacturing Business Survey Committee, pointed out that it was not a demand issue. Manufacturing “remains in a demand-driven, supply-chain-constrained environment”. Data from the Wabtec Port Optimizer shows that the number of inbound containers passing through the Port of Los Angeles in April lagged a year earlier. The U.S.’s busiest container port this week is on track to match levels for the same period in 2021, according to estimates on Tuesday. Given the impact of the pandemic, these fluctuating numbers will be worth watching in the coming weeks.

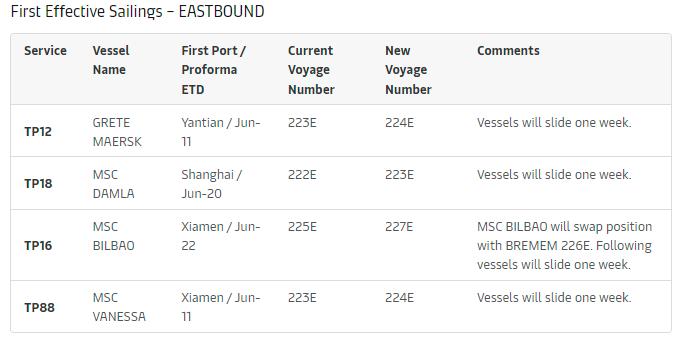

On the 2nd, Maersk announced that the sailings of several voyages on the trans-Pacific route will be delayed by a week, citing “the continued accumulation of delays in the service network due to terminal congestion and vessel accidents”.

Post time: May-07-2022